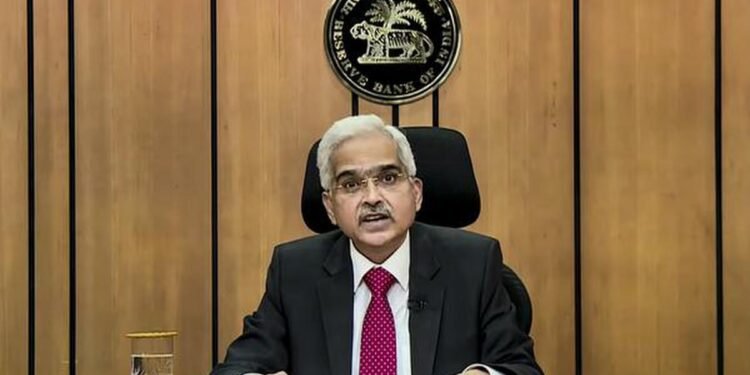

– The Monetary Policy Committee (MPC) overseen by the Reserve Bank of India (RBI) concluded its monetary policy review from April 3-5. RBI Governor Shaktikanta Das is set to announce the outcome today. According to a survey of 21 bankers, economists, and fund managers, it’s anticipated that the MPC will maintain the status quo, keeping the repo rate unchanged at 6.5 percent. Additionally, the majority of respondents foresee no alteration in the policy stance.

– Recent statements from RBI Governor Shaktikanta Das underscore the central bank’s cautious approach regarding policy rates. The RBI remains vigilant on inflation, aiming to sustainably bring it down to the 4 percent medium-term target. Das emphasized this stance at a recent event.

– Several factors indicate that the rate-setting panel is unlikely to surprise markets at the upcoming review. First, while retail inflation has been gradually easing, it remains above the central bank’s target. Second, the MPC closely monitors global interest rates, particularly the actions of the US Federal Reserve, before considering rate reversals. Third, seasonal factors typically lead to an uptick in food inflation in March. Fourth, the RBI emphasizes the need for effective monetary policy transmission in the banking system. Finally, India’s economic growth remains robust, providing further rationale for the MPC to maintain interest rates.

– On the inflation and growth fronts, the RBI is expected to adjust its forecasts, taking into account easing fuel prices and strong economic growth indicators. The RBI governor hinted at a GDP growth rate close to 8 percent for the current fiscal year ending in March.

– The RBI-led policy panel is likely to maintain a cautious stance on inflation and replicate the previous monetary policy, possibly hinting at future rate cuts contingent on inflation comfortably aligning with the 4 percent target.

Business

Business INDIA

INDIA Stocks

Stocks