Tata Group Prepares for Multiple Public Issues to Drive Future Growth

Former United States President Donald Trump asserts he is “very open-minded” to “all aspects of this emerging and growing industry.”

After a prolonged hiatus, the Tata Group is gearing up to launch several public issues over the next two to three years. This strategic move by Tata Sons aims to unlock value, fuel future growth, and provide exit options for select investors, according to a recent report.

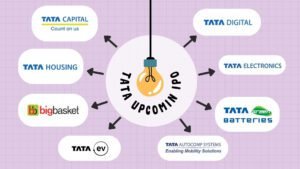

Executives revealed that companies such as Tata Capital, Tata Autocomp Systems, Tata Passenger Electric Mobility, BigBasket, Tata Digital, Tata Electronics, Tata Housing, and Tata Batteries are being prepared to enter the capital markets. The group is aggressively expanding its presence in new-age sectors like digital, retail, semiconductors, and electric vehicle batteries.

An executive, speaking anonymously, stated, “Approaching the capital markets is a strategic decision, not an impulsive rush into IPOs.” Another executive noted, “Many businesses seeded 20 to 25 years ago are now in a growth phase and ready to be monetized. Specific companies are making calculated decisions in discussions with Tata Sons to offer exit opportunities to existing investors or unlock value. There are no strict deadlines; decisions will be well thought out.”

The Tata Group’s last public offering was in November 2023, when Tata Technologies launched a ₹3,000-crore IPO, marking the conglomerate’s first public issue since Tata Consultancy Services (TCS) went public in 2004.

A former group director commented, “Previously, the strategy focused on overseas growth through acquisitions. Now, there’s a shift towards India-focused growth. The group is taking bold bets on scalable businesses, but I don’t foresee a dramatic rush for IPOs.”

In the final quarter of 2022, the conglomerate announced plans to invest $90 billion in emerging industries by 2027, including mobile components, semiconductors, electric vehicles, batteries, renewable energy, and e-commerce. However, according to a February 29 report by the Economic Times, the Tata Group is set to exceed that level, investing over $120 billion in the coming years.

Business

Business INDIA

INDIA Stocks

Stocks