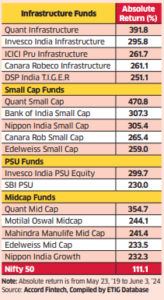

During the second tenure of the Modi government from May 2019 to June 2024, infrastructure, PSU, mid-cap, and small-cap mutual funds delivered the highest returns for investors.

Investors showed a strong preference for PSU stocks, particularly in segments like railways and defense. After a prolonged period of underperformance, the banking NPA cycle turned around, and with the core economy performing well, valuations became more attractive.

The government’s strategic stake sales also boosted investor sentiment towards PSU companies. Mid-cap and small-cap companies in niche sectors such as infrastructure, chemicals, capital goods, and consumer discretionary experienced higher profitability and earnings growth, driving their stocks to outperform benchmark indices.

The focused government policies and economic reforms created a favorable environment for these sectors, leading to significant gains in mutual fund returns. The performance of these funds underscores the importance of strategic government initiatives and the growing investor confidence in the Indian stock market.

Business

Business INDIA

INDIA Stocks

Stocks