The RBI will closely monitor liquidity, growth, and inflation over the coming weeks and months. Despite this, it is likely to maintain the current interest rates, marking the second RBI MPC meeting of FY25.

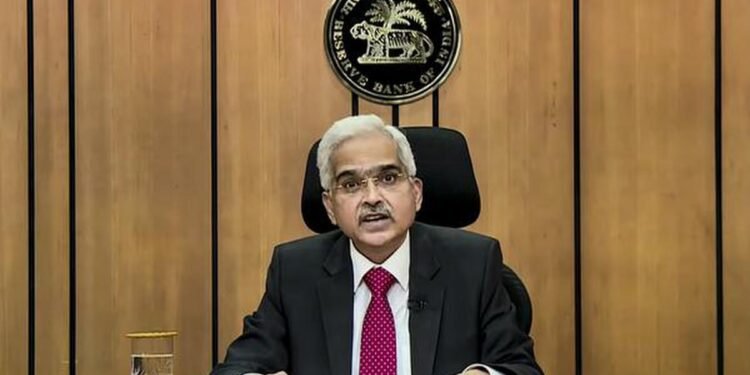

The RBI governor, Shaktikanta Das, led the Monetary Policy Committee in keeping the repo rate unchanged, as anticipated. The meeting spanned from June 5 to June 7. The repo rate, which is the rate at which the Reserve Bank of India lends to commercial banks, remains at 6.5%. Since initiating the rate hike cycle in 2022, the RBI has increased the repo rate by 250 basis points.

The Monetary Policy Committee consists of six members and aims to keep Consumer Price Inflation (CPI) around the 4% target, within a +/- 2% range. While inflation has been within the central bank’s comfort zone recently, the approaching monsoon season may prompt the MPC to adopt a cautious stance. India’s GDP growth for the fiscal year 2023-24 exceeded expectations at 8.2%, further diminishing the likelihood of a repo rate cut.

The RBI will also observe the policies of the newly elected Modi-led NDA government, particularly regarding fiscal measures, to assess their impact on inflation.

Loan borrowers pay close attention to RBI’s monetary policy for potential relief in loan EMIs. A higher repo rate makes it more expensive for banks to borrow, resulting in higher interest rates for loan borrowers. Conversely, any rate cut would lower EMIs. Governor Shaktikanta Das emphasized the importance of adhering to guidelines on Key Fact Statements (KFS), noting that some entities are charging unspecified fees and maintaining high interest rates on small loans. Ensuring fair and transparent product pricing remains crucial.

Business

Business INDIA

INDIA Stocks

Stocks

this is a nice post