Shift in Household Savings

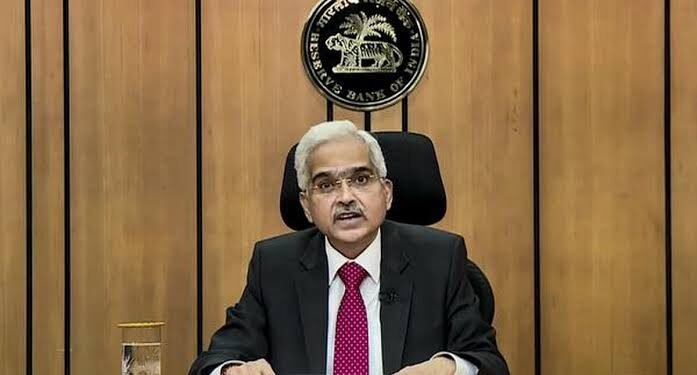

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, has observed a significant shift in how Indian households are saving their money. Traditionally, people preferred to keep their savings in bank deposits. However, there’s now a noticeable trend of these savings moving towards mutual funds. This change is affecting the liquidity of banks, as they are seeing fewer deposits.

Reasons for the Shift

Several factors are driving this shift:

- Higher Returns: Mutual funds offer higher returns compared to traditional bank deposits.

- Low Interest Rates: With interest rates on bank deposits remaining low, investors are looking for better returns through mutual funds.

- Increased Awareness: More people are becoming financially literate and exploring mutual funds as a viable investment option.

Impact on Banks

The RBI Governor highlighted that this trend could impact the banking sector’s liquidity. Banks rely heavily on deposits to fund their lending activities. A decline in deposits can limit their ability to lend, potentially affecting credit growth in the economy. This situation requires banks to look for alternative sources of funding to maintain their lending capacity.

Growth of Mutual Funds

The mutual fund industry has been growing significantly:

- Assets Under Management (AUM): The AUM of mutual funds have been increasing, reflecting the growing confidence of investors.

- Systematic Investment Plans (SIPs): Sustained inflows into mutual funds, particularly through SIPs, indicate a shift towards more disciplined and long-term investment strategies among retail investors.

RBI’s Response

In response to this trend, the RBI is closely monitoring the situation and may consider measures to ensure that banks have adequate liquidity to support their lending operations. The central bank’s focus is on maintaining financial stability while encouraging the development of a diversified and robust financial system.

Conclusion

Overall, this shift towards mutual funds is reshaping the landscape of household savings in India. It is driven by the search for higher returns and greater financial awareness, and it has important implications for the banking sector’s liquidity and the broader financial system.

Business

Business INDIA

INDIA Stocks

Stocks