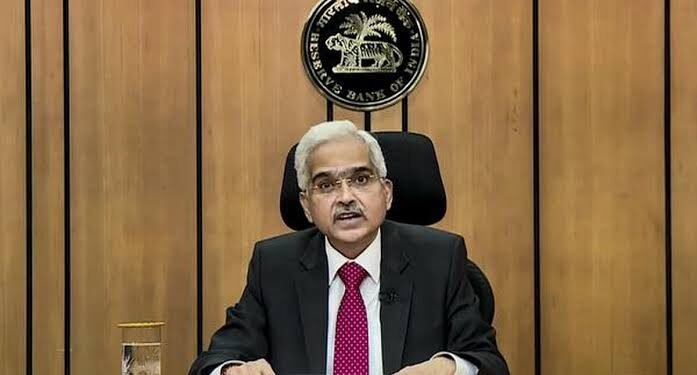

The Reserve Bank of India (RBI) has once again decided to keep the repo rate unchanged at 6.5%, marking the ninth consecutive time. This decision comes as the six-member Monetary Policy Committee (MPC) faces ongoing risks from higher food inflation. The MPC also continued its stance on the withdrawal of accommodation.

RBI Governor Shaktikanta Das noted that inflation has been on a declining path. The last repo rate cut occurred in May 2020, when the RBI reduced it by 40 basis points to 4% in response to the Covid-19 pandemic. The pandemic severely impacted the economy, causing a drop in demand, production cuts, and widespread job losses. Since then, the RBI has increased the repo rate by 250 basis points, bringing it to the current 6.5% to combat high inflation.

Impact on Borrowers and the Stock Market

With the repo rate holding steady at 6.5%, borrowers linked to external benchmark lending rates (EBLR) will find relief as their equated monthly installments (EMIs) will not rise. However, those with loans tied to the marginal cost of fund-based lending rate (MCLR) might still see an increase in interest rates. The full transmission of the 250 basis points hike between May 2022 and February 2023 has not yet occurred. Banks have already adjusted their repo-linked EBLRs upwards, and the 1-year median MCLR of banks increased by 168 basis points from May 2022 to June 2024.

Finance and Stock Market Outlook in India

The steady repo rate provides some stability for borrowers, which might positively impact consumer spending and investment. This decision by the RBI could influence the stock market, particularly banking and finance stocks, as it reflects the central bank’s cautious approach to managing inflation while supporting economic growth.

By maintaining the repo rate at 6.5%, the RBI aims to balance inflation control with economic stability, a crucial factor for India’s finance sector and overall market health.

Business

Business INDIA

INDIA Stocks

Stocks