Congressman Lance Gooden Challenges DOJ Lawsuit Against Adani Group Over Alleged Bribery

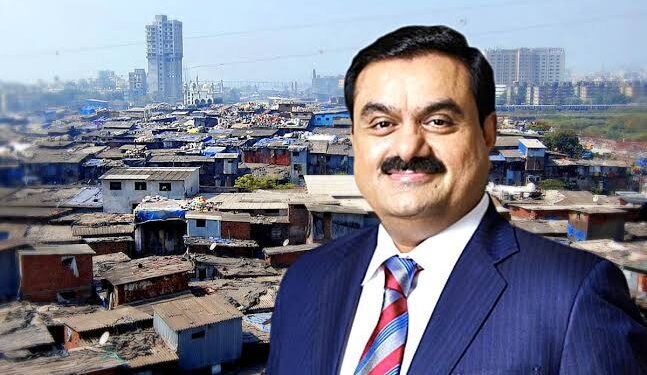

Republican Congressman Lance Carter Gooden, a staunch supporter of U.S. President-elect Donald Trump, has openly criticized the Department of Justice (DoJ) for filing a lawsuit against Gautam Adani and seven others. The suit alleges that the Adani Group bribed state government officials in India to secure solar power supply contracts from state-owned utilities.

The DoJ filed the case on November 20, 2024, in the Eastern District Court of New York, accusing the Adani Group of paying $265 million in bribes across five Indian states—Andhra Pradesh, Telangana, Tamil Nadu, Bihar, and Chhattisgarh.

In a letter to U.S. Attorney General Merrick Garland, Gooden expressed disapproval, arguing that the DoJ’s actions target companies that contribute significantly to the U.S. economy. “Targeting entities that invest tens of billions of dollars and create thousands of jobs for Americans ultimately harms us,” he stated.

Gooden emphasized India’s strategic importance as a partner in the Asia-Pacific region and one of the world’s largest and fastest-growing economies. “Reckless pursuits against top industrialists could harm India’s growth and our bilateral relations,” he warned.

The Congressman highlighted that the alleged bribes were paid in India by Indian executives to Indian officials, with no direct impact on the U.S. He questioned the DoJ’s jurisdiction, suggesting that the matter should be resolved by Indian authorities.

The Adani Group, which announced plans to invest $10 billion in U.S. infrastructure and energy projects, faces charges under the Foreign Corrupt Practices Act (FCPA) and securities fraud. However, the group has denied violations of the FCPA by key executives Sagar Adani and Vneet Jaain.

Observers believe the group remains committed to its investment plans in the U.S., with projects potentially creating up to 15,000 jobs. The announcement came after Gautam Adani congratulated Trump on his election victory via social media, affirming the deepening U.S.-India partnership.

While Gooden acknowledged the importance of enforcing anti-corruption laws, he cautioned against premature conclusions that could jeopardize international relations and financial cooperation. “Respecting India’s authority to investigate and resolve this issue is the best course of action,” he added.

The allegations have raised concerns about the Adani Group’s fundraising efforts in international markets, as the controversy unfolds. With President-elect Trump set to assume office on January 20, some wonder if he might revisit the FCPA, a law he previously criticized as “horrible.”

Gooden’s stance highlights the intersection of finance, international relations, and the stock market, with the Adani Group’s case serving as a pivotal moment for U.S.-India economic collaboration.

Business

Business INDIA

INDIA Stocks

Stocks