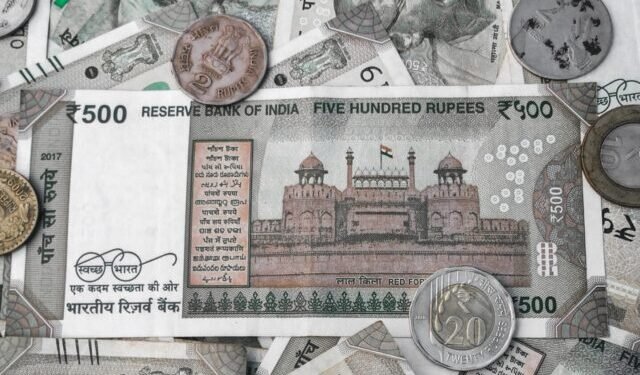

India stands at the threshold of a monumental economic upswing, poised to attract an estimated $100 billion in foreign investments with its recent inclusion in global bond indices. This development is set to capture the attention of institutional investors, including sovereign wealth funds and pension funds, seeking diversification opportunities for their portfolios.

The decision to include India in these indices underscores the country’s robust monetary and fiscal policies, coupled with recent economic advancements and policy reforms. Collectively, these factors have elevated India’s standing in the global investment landscape, positioning it as an attractive destination for discerning investors.

Bolstered by a stock market valuation reaching the $4 trillion milestone, India’s economic foundation is further strengthened by a significant influx of foreign portfolio investments. The growing confidence in the Indian market is attributed, in part, to its strategic appeal as an alternative to other markets, notably China, which has encountered various challenges.

Financial institutions, such as HSBC Mutual Fund and HSBC Asset Management, express optimism regarding the potential for capital inflows following India’s inclusion in global bond indices. Their positive outlook reflects the evolving dynamics of the Indian market and its increasing attractiveness to global investors.

Business

Business INDIA

INDIA Stocks

Stocks