Retail net investments in India’s secondary markets fluctuated significantly from 2022 to 2023. In 2022, retail investors poured Rs 37,400 crore into cash markets and allocated Rs 24,800 crore to the futures and options (F&O) segment, totaling Rs 62,200 crore. However, 2023 saw a drastic shift. Cash market investments plummeted to Rs 8,700 crore, a sharp decline of 76.7%, while F&O investments surged by 106.0%, reaching Rs 51,100 crore. Despite the increase in F&O investments, the overall net investment dropped to Rs 59,800 crore, marking a year-on-year decline of 3.9%.

This trend highlights a noteworthy shift in retail investor preferences from cash markets to F&O instruments. The significant decline in cash market investments could be attributed to changes in market sentiment, economic conditions, or regulatory developments. Conversely, the substantial increase in F&O investments indicates a growing appetite for risk and speculation among retail investors.

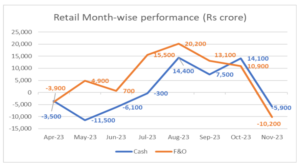

Examining the month-wise performance data for retail investments in the secondary markets from April to November 2023 further reveals the dynamic nature of retail investor activities. In April 2023, both cash and F&O segments experienced negative performances, with cash investments at Rs -3,500 crore and F&O investments at Rs -3,900 crore. May saw a significant decline in cash investments to Rs -11,500 crore, while F&O rebounded to Rs 4,900 crore, indicating a mixed trend. June continued this trend with negative cash investments at Rs -6,100 crore, but with a modest increase in F&O investments to Rs 700 crore.

July marked a turning point with cash investments improving to Rs -300 crore, indicating reduced negative cash flows, while F&O investments surged to Rs 15,500 crore, showcasing heightened interest in derivatives. August and October displayed positive momentum, with cash investments reaching Rs 14,400 crore and Rs 14,100 crore, respectively. In August, F&O investments peaked at Rs 20,200 crore, demonstrating a robust appetite for derivative instruments. September and November witnessed fluctuating trends in flows, with Rs 7,500 crore and Rs -5,900 crore, respectively.

The data reveals a diverse pattern of retail investor behavior, with varying levels of risk appetite and preferences for cash or derivative instruments across different months. Positive cash flows in August and October coincided with the surge in F&O investments, implying a potential relationship between the two. These trends underscore the importance of monitoring monthly variations to gain a comprehensive understanding of retail investor sentiment and market dynamics.

In conclusion, retail investor behavior shifted significantly from cash to derivatives (F&O) between 2022 and 2023, with a 76.7% decline in cash investments and a 106.0% surge in F&O investments. Monthly fluctuations highlight the dynamic nature of retail investor sentiment, reflecting both positive and negative cash flows and corresponding changes in F&O investments. This suggests varying risk appetites, with positive cash flows in months like August and October coinciding with significant F&O investments, potentially indicating a preference for riskier assets or speculative trading. These observed shifts in behavior may also be influenced by market events or regulatory changes, emphasizing the need for continuous monitoring. Overall, the data highlights a dynamic landscape where retail investors actively adapt their strategies, underscoring the importance of nuanced understanding for effective decision-making.

Business

Business INDIA

INDIA Stocks

Stocks