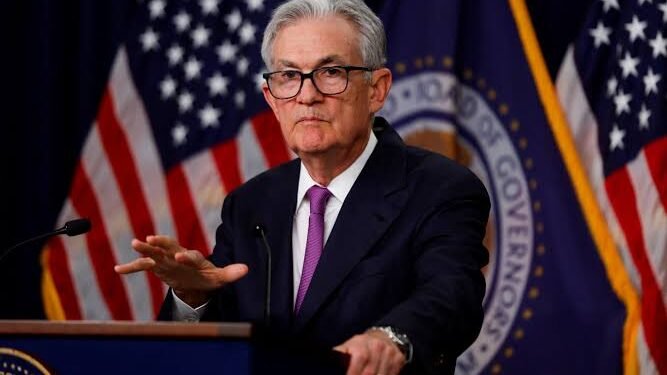

Federal Reserve Chair Jerome Powell has indicated that while U.S. inflation is showing signs of slowing, it is not yet sufficient to warrant cutting interest rates. During a panel discussion in Amsterdam, Powell emphasized the need for patience, noting that recent inflation figures have exceeded expectations, suggesting that achieving the necessary confidence to relax monetary policy will take longer than anticipated.

Powell acknowledged that inflation is gradually cooling but expressed reduced confidence in this trend due to higher-than-expected inflation readings in the early months of the year. He highlighted that the Federal Reserve would likely maintain its current interest rate levels, refraining from further hikes for now, but also indicated that rate cuts are not imminent until more substantial evidence of sustained inflation reduction is observed.

The Fed’s strategy has been to keep interest rates high to curb borrowing and spending, thereby cooling the economy and inflation. Despite this, the inflation rate remains above the Fed’s target, with core inflation, excluding food and energy, still running higher than desire.

Looking ahead, many investors anticipate the Fed might begin cutting rates later this year, possibly around September or November, though only a few reductions are expected compared to earlier predictions of more aggressive cuts. This cautious approach underscores the Fed’s commitment to ensuring that inflation is on a clear downward path before easing its monetary stance.

Business

Business INDIA

INDIA Stocks

Stocks