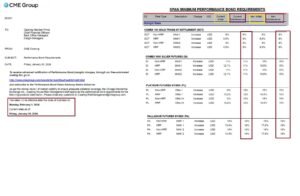

Gold and silver prices are facing pressure in the Indian market as global cues and domestic expectations weigh heavy. The recent 33% increase in margin by CME , forcing square off has added to volatility, making traders cautious.

Investors are also keeping a close watch on the upcoming Union Budget 2026, which is expected to bring key announcements impacting commodities and overall market sentiment.

Investors are also keeping a close watch on the upcoming Union Budget 2026, which is expected to bring key announcements impacting commodities and overall market sentiment.

Gold futures on MCX slipped as global prices softened, reflecting nervousness among traders. Silver too followed the same trend, with prices under pressure due to reduced speculative activity after the margin hike. Analysts believe that the Union Budget will play a crucial role in shaping demand, especially if there are changes in import duties or policies related to precious metals.

Globally, gold prices are reacting to stronger US dollar trends and expectations around interest rates. Silver, being both an industrial and investment metal, is more sensitive to global growth signals, which remain mixed.

Experts advise investors to stay cautious in the short term, as volatility may continue until clarity emerges from the Budget. Long-term fundamentals for gold remain strong due to its safe-haven appeal, while silver’s outlook depends on industrial demand recovery.

In short, traders are balancing global cues, CME’s margin hike, and Budget 2026 expectations before making fresh moves in gold and silver.

Business

Business INDIA

INDIA Stocks

Stocks